I've tried writing this several times and keep getting stuck...then with being out of town for the last 10 days I continued to put it off. Well here it goes, even if it is a month late.

SO, we survived our first month on a budget! It wasn't really that bad...we did have some surprises come up, but like I said we survived and we were able to make a nice big payment on one of our loans...oh it felt so good. Kinda nerdy, I know, but it's fun!

| |

| Beginning of January: First Budget Committee Meeting. |

Almost a year ago when we first attempted to live on a budget, we came up with some numbers to stay within (very generous numbers cause we had no idea where to start) and found an app on our phones to keep track of what/where we spent money. Needless to say, it was a disaster, we kept using the excuse that we didn't really know what was realistic so if we went over it was OK. Plus, if I remember correctly, we didn't name every dollar. Meaning we didn't allocate all of our income into categories, so that at the bottom of the budget page, income to outgo didn't equaled zero. We only created a couple of categories, like food/gas/utilites/rent. Basically, we half heartily made a budget and then didn't even stay within the budget amounts. But our biggest mistake, was that we didn't come together at the end of the month before the new month started and go over our budget. Essentially, we had already given up.

This time we made sure that every dollar that we earned in January was accounted for, we made enough categories this time to do so, which helped us tremendously. By doing so, we created an actual budget, and even though it was our "first" month we tried very hard to make each budgeted amount realistic and forced ourselves to stay within those means.

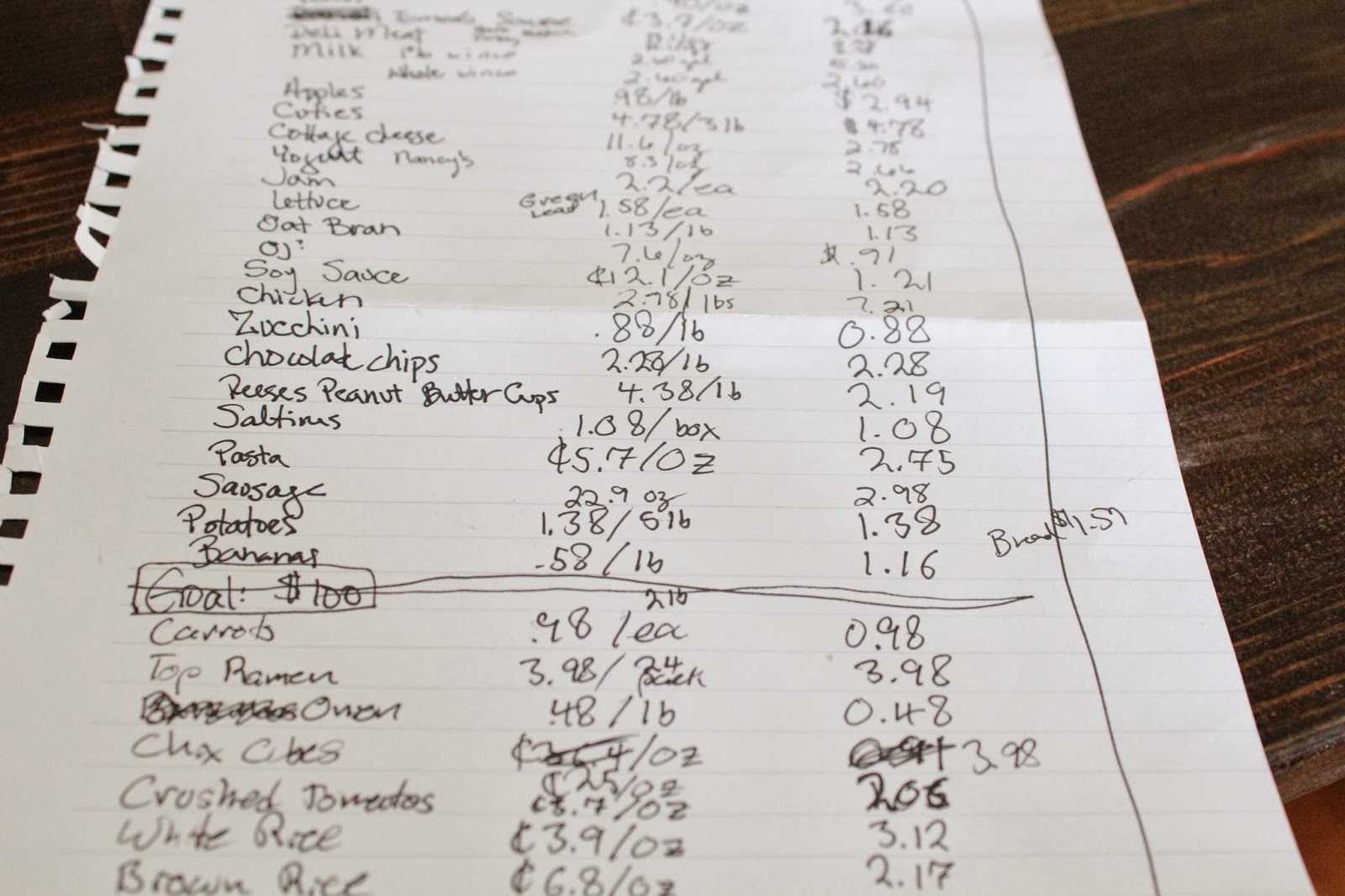

Positive Experience this month: Grocery shopping! I have always felt like I spend so much money when I go to the grocery store. This time it was so nice to have Andrew with me (he took the afternoon off for our ultrasound appt in Bellingham) to help stay on budget. I had made a list of items we needed to get and made a column next to each item to write down the price of that item and price per unit. With his help we were able to keep a running total while we shopped. And guess what? It worked great! We had budgeted $100 and our running total came to about 40 cents off the actual amount paid, which was $91.75. We were even able to buy a couple of unnecessary items (like chocolate chips for cookies) because we knew how much money we had left in our budget, before we even checked out! We were so proud of ourselves =)

Challenges/Unexpected expenses this month: For the month of January we had two unexpected/additional expenses: a speeding ticket we had received during Christmas break and an ultrasound bill payment that we didn't know our insurance wouldn't cover entirely. We placed them in our debt category and paid them off right away since they were our smallest debt. Then used the rest of our budgeted money for debt to put towards our other two loans. It really wasn't that big of a deal but kind of a bummer that our very first month we couldn't put the entire amount budgeted for loans toward them exclusively.

Helpful tips from this month: We created a category in our budget which included: Auto insurance, weddings this summer and our baby's birth. These are things that we want to have extra money saved for when they come up. For example we don't pay auto insurance monthly but we are putting money away every month for when we need to pay that bill, which is quarterly. Weddings and birth are things we want to have money set aside for. What was very helpful for me, seeing as I am a visual person, is we transferred this money to a different bank account. That way, at the end of the month this money wasn't sitting in our main bank account, seeming like we have extra money left to go towards loans. I needed to see the money go somewhere, in order for it to feel like it was being used. I hope that makes sense and I would highly recommend doing something like this if you need to put money aside and have troubles seeing that that money is already accounted for.

Alrighty well that's the scoop on our first month. February is soon to come, hopefully.

Positive Experience this month: Grocery shopping! I have always felt like I spend so much money when I go to the grocery store. This time it was so nice to have Andrew with me (he took the afternoon off for our ultrasound appt in Bellingham) to help stay on budget. I had made a list of items we needed to get and made a column next to each item to write down the price of that item and price per unit. With his help we were able to keep a running total while we shopped. And guess what? It worked great! We had budgeted $100 and our running total came to about 40 cents off the actual amount paid, which was $91.75. We were even able to buy a couple of unnecessary items (like chocolate chips for cookies) because we knew how much money we had left in our budget, before we even checked out! We were so proud of ourselves =)

Challenges/Unexpected expenses this month: For the month of January we had two unexpected/additional expenses: a speeding ticket we had received during Christmas break and an ultrasound bill payment that we didn't know our insurance wouldn't cover entirely. We placed them in our debt category and paid them off right away since they were our smallest debt. Then used the rest of our budgeted money for debt to put towards our other two loans. It really wasn't that big of a deal but kind of a bummer that our very first month we couldn't put the entire amount budgeted for loans toward them exclusively.

Helpful tips from this month: We created a category in our budget which included: Auto insurance, weddings this summer and our baby's birth. These are things that we want to have extra money saved for when they come up. For example we don't pay auto insurance monthly but we are putting money away every month for when we need to pay that bill, which is quarterly. Weddings and birth are things we want to have money set aside for. What was very helpful for me, seeing as I am a visual person, is we transferred this money to a different bank account. That way, at the end of the month this money wasn't sitting in our main bank account, seeming like we have extra money left to go towards loans. I needed to see the money go somewhere, in order for it to feel like it was being used. I hope that makes sense and I would highly recommend doing something like this if you need to put money aside and have troubles seeing that that money is already accounted for.

Alrighty well that's the scoop on our first month. February is soon to come, hopefully.

No comments:

Post a Comment