I just posted March's Dumping Debt...now lets see how long before this post is actually ready to go.

**OK, it's May 29th and I still haven't finished this post, so long for getting Aprils month done early!**

**OK, it's May 29th and I still haven't finished this post, so long for getting Aprils month done early!**

We've changed a few things up this month, had some mental struggles and have given into some indulgences, what can we say we're only human right? Get ready, it's a long one this month!

Positive experience this month: Family's generosity and persistence allowed Malachi and I to fly to Portland to see Andrew's Grandma, and little gifts we were given for Easter to treat ourselves. Plus, I felt we spent a lot of money on groceries because of Easter, but we actually didn't go over budget for food!

Challenges/Unexpected expenses this month: I love listening to Dave Ramsey's radio show, it motivates me hearing other peoples' debt free scream, I learn A LOT about different aspects of finances and it always gets me excited for the Budget committee meeting with my handsome husband. However, what I haven't shared with you all, because I've been reluctant to do so, is that most of the meetings, at some point, I end up in tears. I'm not sure if I can actually blame it on being pregnant or not, I don't like to but that could be a reason I get so emotional. As much as I am excited for all of this, I always end up confused during our meetings. For example: It's hard to keep track in our paperwork when we are paid in US dollars but then have to pay utilities in Canadian dollars....or having different bank accounts with different incomes (Kiewit in one and Military in another, USAA's regulations for accepting their Career starter loan), and last but not least getting paid weekly. I loved the fact that we got paid weekly when living in the states but now that we are in Canada, it's pretty annoying. The reason being; we have to make sure we bring enough cash to exchange to pay for rent and utilities otherwise we have to make another trip to the states. Yes we can do a wire transfer but it ends up being $30-40 with all the different bank fees and such...that's actually conservative, I think when we calculated it all up it was actually in the $50's. I think it's ludicrous to pay those fees and refuse to do so, when it cost less to just make a trip...however it's just not always convenient when you have a little one and in your third trimester. Anyway, being paid weekly means we may not have enough in our account at that time, which then means making another trip to Bellingham. Also, getting paid weekly is hard to work out in a budget. I mean if we get paid say, 3-4 days before the new month has started then half of that weeks paycheck goes to the new month right?

When we started all of this Andrew figured out the average of each month and that's what we've been using for our budget paperwork...we figured that would incorporate the money that splits between two months and so on. What I don't get is; we've gone over our budget every month, but always have extra money in our bank account. Now if you remember there were times that we had extra money, by God's grace (cashing in our credit card points) but if you look at our paperwork, it just doesn't make sense, we really shouldn't have the extra money that we do at the end of each month, but still be over in all of our paperwork. Every time we go through the paperwork I just feel like a failure because we're always in the red but then our bank account still has plenty of money in it. Maybe I should just be happy that we have extra rather than the opposite, and it's a blessing. But my control side of me wants to know how this is happening, and I get upset when I can't make sense of things. What we've decided though is to no longer use the average but add up how much we're actually going to earn for that month and base our budget on that. And if there's a day or two in the new month that was included in the previous weeks paycheck, we'll split that paycheck up so those days are accounted for. Hopefully that will make things better. Don't get me wrong, I'm still excited and looking forward to our budget committee meeting this weekend, I like the challenge of all this but do get a little upset at times.

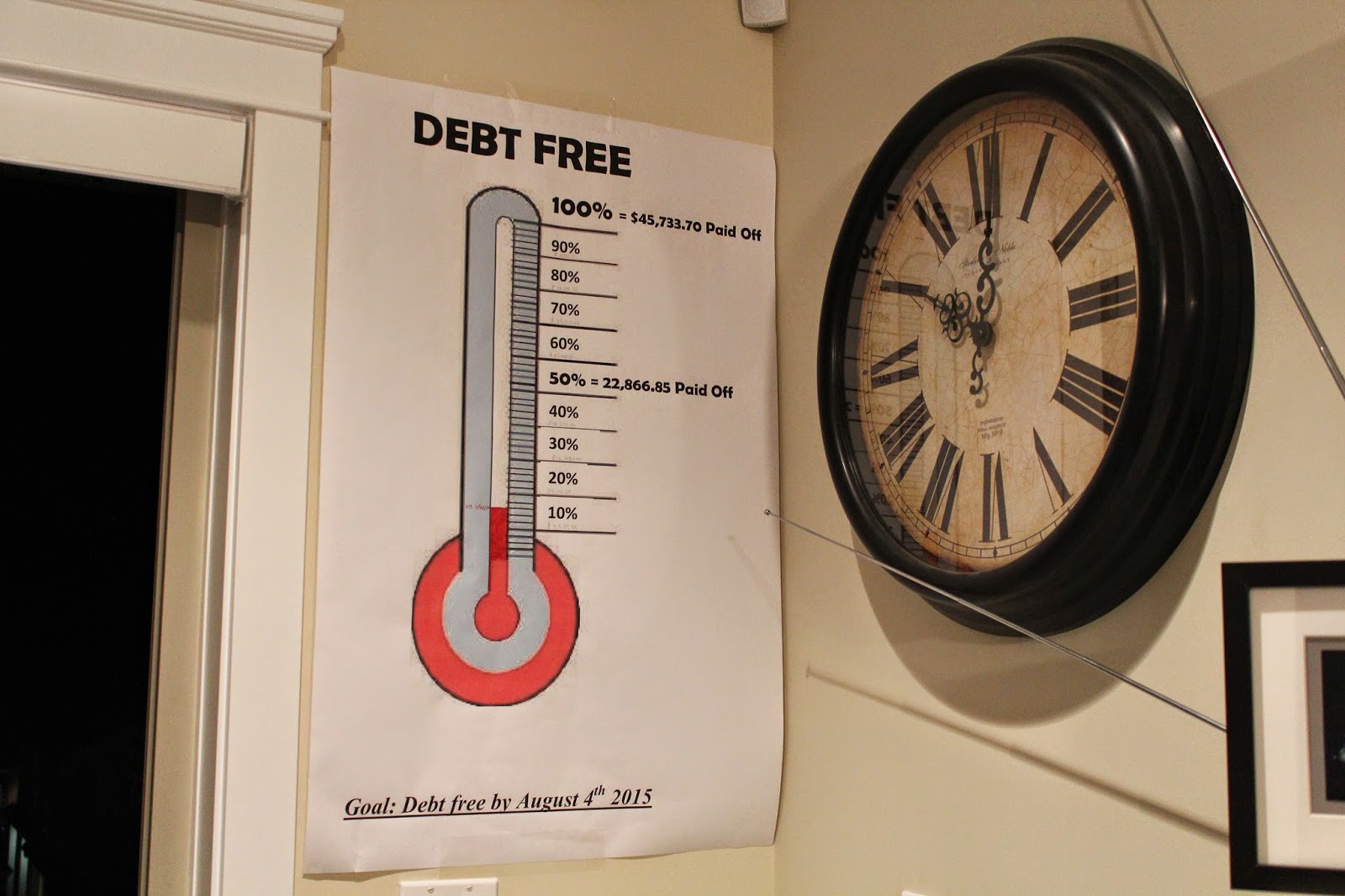

Remember how I mentioned Andrew just likes making graphs and excel spreadsheets...well I've joined him in the "nerdyness.". While he was at work one Saturday I made our very own Debt Free Thermometer. I emailed it to him as a joke and a little bit later I got this picture back:

Remember how I mentioned Andrew just likes making graphs and excel spreadsheets...well I've joined him in the "nerdyness.". While he was at work one Saturday I made our very own Debt Free Thermometer. I emailed it to him as a joke and a little bit later I got this picture back:

|

Helpful tip this month: One change we made this month is we've put a stop to our Debt snowball,

we are only paying the minimums on the loans and saving the extra money

to go towards our baby's birth, just as a precaution. Then if everything turns out fine, we

will put all that money setting aside straight towards loans once the baby

is home safe and sound. This is something that Dave Ramsey has suggested

from the beginning but we have just started to do. His reasoning is in

case there is an emergency we will have extra money set aside to deal

with it. Our reasoning is since we are up here in Canada, we have to pay

out of pocket for Doctors appointments and then get reimbursed by our

insurance. So we need that extra money available and I am so thankful for having this insight before we give birth! God has taken care of us in that way majorly! We've already had to give a $2,000 deposit to our doctor so having that money available as been a huge blessing.

Dave Ramsey suggests this for anything major that may happen in the near future, like the possibility of a job loss, moving etc.

Also, something I never mentioned is in March we cashed in some savings bonds that we've had this whole time. It's so tempting to just hang onto them as a back up plan, but we're continuously told that the interest the bonds are accruing is nothing compared to the interest gaining on our loans. It only makes sense to cash them in and put towards loans. But remember they've gone into our "baby emergency" account as of right now....hopefully in June or July it will be clear that baby is totally fine (God willing) and we can make a nice huge payment towards our loans! Which we are very much looking forward to!

Dave Ramsey suggests this for anything major that may happen in the near future, like the possibility of a job loss, moving etc.

Also, something I never mentioned is in March we cashed in some savings bonds that we've had this whole time. It's so tempting to just hang onto them as a back up plan, but we're continuously told that the interest the bonds are accruing is nothing compared to the interest gaining on our loans. It only makes sense to cash them in and put towards loans. But remember they've gone into our "baby emergency" account as of right now....hopefully in June or July it will be clear that baby is totally fine (God willing) and we can make a nice huge payment towards our loans! Which we are very much looking forward to!

No comments:

Post a Comment